by futurist Richard Worzel, C.F.A.

When we think about the future, we typically think in terms of an evolution: smooth changes that happen gradually over time.

Yet, change often comes as a revolution, suddenly, and in discontinuous jumps. I believe that’s what’s happening today with the future of energy.

What we are experiencing now, and what will produce this discontinuous future, is the result of an irresistible force meeting an immovable object, and I believe the fossil fuels industry in general, and petroleum in particular, is going to be irreparably hurt by the changes to come.

Fossil fuel companies that plan to survive should be thinking about business beyond this horizon.

The Irresistible Force

The irresistible force is climate change. Greenhouse Gases (GHGs) create a greenhouse effect (hence the name), which causes temperatures to rise. And GHGs in the atmosphere are now higher than at any time since humans existed on the Earth.

And although the link between human activity and temperature rise is well documented and accepted by virtually all climatologists, from a risk management point of view, whether it’s humanity’s fault or not is irrelevant. If your house is on fire, you don’t throw gasoline on it, no matter how it started.

Likewise, whether we are the cause of climate change or not, we still shouldn’t be throwing fuel – in this case, CO2 – on the fire, being a rapidly warming climate.

The Immovable Object

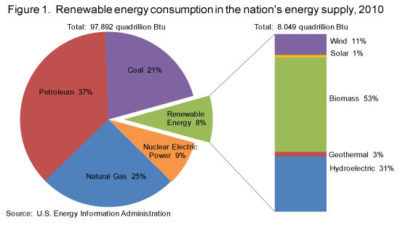

The immovable object is fossil fuels. We use massive amounts of energy, most of which comes from fossil fuels. And our use continues to grow steadily because it’s directly related to our standard of living.

And since the vast majority of our energy is generated with fossil fuels, that means that weaning ourselves from fossil fuels in a short period of time is impossible for all practical purposes. So, the idea of eliminating fossil fuels probably can’t happen for decades, even with the best will in the world.

Or can’t it?

Why Climate Change Will Force a Switch from Fossil Fuels

Put simply, the effects of climate change are becoming real, immediate, obvious, and severe. They will alarm enough people that a powerful voting and consumer movement is emerging, demanding that we switch away from fossil fuels. And this shift in demand is going to trigger economic changes that will become irresistible.

To date, one of, if not the most powerful thing that can convince someone of climate change is for it to affect them directly, typically through an extreme weather event. And one thing climatologists have been very clear on – and very right about – is that while any given weather event may not be traceable to climate change, the number and ferocity of extreme weather events have not only risen because of climate change, but their incidence and ferocity will continue to increase, and at an accelerating rate.

So, how bad could such events become? As an analogy, imagine there’s a fierce storm raging outside your home, such as this violent Texas thunderstorm:

Your natural reaction would be to hunker down indoors until it passes. Yet, what if it doesn’t pass, but just continues to get worse. What do you do then?

This is just an analogy – weather isn’t climate, although they are linked. But the analogy is that we are already experiencing more extreme, and more frequent extreme weather events – and they are going to continue to get worse, and at an accelerating pace. The consequences will cost us trillions of dollars in repairs and lost property.

A few present day examples include:

- Hurricane Harvey in 2017, which was the third “once in 500-year” flood to happen in three years,[2]and caused an estimated $125 billion in damage, and destroyed or severely damaged more than 200,000 homes.

- Miami’s “clear sky” flooding, which regularly floods downtown streets and the first floor of office buildings when there are no storms, forcing the city to spend half a billion on flood control.

- Northern California’s wild fires in 2018, which caused more than an estimated $20 billion in damage, destroyed more than 19,000 homes & businesses structures, and killed more than 88 people.[3]

- Temperatures exceeding 50 degrees Celsius (122 degrees Fahrenheit) were recorded in the Middle East & India in 2017 & 2018, and killed hundreds of people.

- The historic and unprecedented flooding in 2019 in the American Midwest, and the Ottawa valley, and parts of Quebec and New Brunswick in Canada. One Canadian commentator noted that homes in the Ottawa River valley at risk of repeated flooding may be uninsurable, and hence, worthless – no one will buy them. And this might apply to 5% of homes in affected regions.[4] Consider what happens if 5% of homes affected by extreme weather events become worthless.

- And New York City has just announced plans to spend $10 billion on a berm to resist what happened to the City and environs with Superstorm Sandy in 2012.

Future projections indicate that the consequences of extreme weather events will be severe – and will accelerate both in frequency and ferocity. For example,

“In vulnerable Southeastern [American] states, coastal flooding is projected to increase dramatically; Charleston, South Carolina, could experience 180 tidal floods in a year by 2045, compared to 11 per year in 2014. In the Southern Great Plains, extreme heat could cause thousands of premature deaths and billions in lost work-hours by the end of the century.… the agricultural sector’s annual losses could reach billions of dollars by the middle of the century.”[5]

So, What Happens Next?

But replacing fossil fuels would be incredibly difficult. It would upend our way of living, and require massive new investments in distribution, manufacturing, and transportation. And doing all that in a short period of time is clearly impossible.

Except something very much like this kind and magnitude of change has happened once before – and not that long ago:

“In 1898 the first international urban-planning conference convened in New York City. It was abandoned after three days, instead of the scheduled ten, because none of the delegates could see any solution to the growing crisis posed by urban horses and their output.”[6]

It would be easy to dismiss the problems of horse manure in cities, and the use of horses as the major form of transportation, as not comparable to our current dependence on fossil fuels. That would be a mistake.

Switching to cars from horses was not simple, and involved massive investments in new infrastructure as well as massive changes in our way of living, including:

- Factories to build the cars.

- Gas stations to fuel them.

- Service stations and mechanics to maintain them.

- An entirely new system of paved roads – billions of miles of them – to enable them to function properly; and

- Thousands, then tens of thousands, and ultimately billions of people learning a new and difficult skill: how to drive a car.

The point is that humans have made, and will make massive changes to infrastructure when we feel the need, and such changes can happen with breath-taking speed.

As a result of the switch from horses to cars and trucks, major new industries sprang up, including two of today’s largest, car manufacturing and gasoline production & supply, with massive new profits for those who were ahead of the curve.

And an even more massive switch in profits will happen in the transition from fossil fuels to the emerging alternatives. A bigger question is: Who is going to claim those profits?

The Fastest Growing Energy Source

Renewable energy is now the fastest growing source of energy. Right now, for example, it is competitive to build and generate electric power using renewable energy, such as wind or solar, without government subsidies.

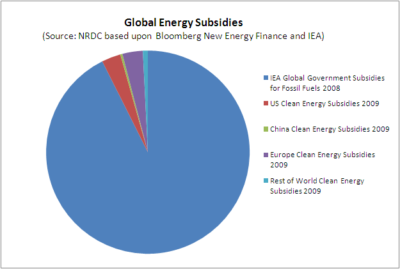

In fact, substantially more money goes to subsidize fossil fuels than renewable energy, although the fossil fuel industry doesn’t spend much time publicizing that.

Moreover, once a solar panel or wind turbine has been installed, the operating costs are substantially lower than for fossil fuels because the “fuel” is free.

Of course, there are still major obstacles to overcome. As everyone knows, “the wind doesn’t always blow, and the sun doesn’t always shine,” which is why there are so many billions of dollars being invested in energy storage technology: whoever comes up with the best technologies will make a fortune.

But ultimately, it doesn’t matter how much better renewables are than fossil fuels. The growth in demand sparked by climate effects will cause a rush into renewable energy that will produce massive profits for those in line to reap them.

And, simultaneously, the bottom will drop out from under the fossil fuel industries. It won’t happen all at once, but rather over decades, and there will still be billions of barrels of oil and cubic meters of natural gas pumped and burned.

But the incremental demand for fossil fuels will slow, then drop, and, given the high overheads inherent in the exploration, production, transportation, distilling, and distribution of petroleum and its by-products, this means that handsome profits will change to dramatic losses. And the prospects of that will cause investors to dump the stock of fossil fuel companies once it becomes clear that change is imminent, and that will happen beforesuch changes actually happen.

This won’t happen overnight, nor will it happen quickly and smoothly. But, as I said before, we are approaching a tipping point. No one knows when, and how quickly, it will happen, but the signs and portents are clear.

The Bottom Line

Turbulent times are times when opportunities are up for grabs.

I don’t know all the energy opportunities that will appear, but I am absolutely certain that they will be plentiful and highly rewarding – if you can identify them early, and address them properly.

The fossil fuel companies are big, and they have lots of smart people working for them, but it remains to be seen whether their managements will cling to the past because it has been so rewarding, or make a leap into an uncertain future.

I am also certain that trying to hold onto the status quo will be both painful and eventually disastrous. Looking at the risks ahead from a futurist’s perspective, it seems clear that the risks of standing still are much greater than the risks of moving forward.

So, what’s the future of energy? We are in uncharted territory. In the short run, fossil fuels will continue to supply the bulk of energy needs, despite their emissions. But change can happen very suddenly – even when it seems like there is no way that it can happen at all, as happened with the switch from horses to cars.

The pressure to do something about climate change will accelerate – and those who wait to do something about it run a very real risk of being left behind, or even trampled when the changes come.

Yet, ultimately it doesn’t matter whether climate change is happening or not – renewable energy is already cheaper than fossil fuels, and will continue to get cheaper still as both new technological breakthroughs happen, and economies of scale kick in. So, regardless of whether fossil fuels are replaced or not, and regardless of whether climate change is happening or not, new opportunities are emerging in energy. Those who can manage these opportunities stand to make massive amounts of money.

So, if there are fortunes to be made – and lost! – in the future of energy, which way do you want to bet? On the past? Or the future?

© Copyright, IF Research, May 2019.

[2]Ingram, Christopher, “Hurricane Harvey is third ‘500-year’ flood in Houston in 3 years”, Washington Post, 29 August 2017.

[3]https://www.bustle.com/p/the-cost-of-california-wildfire-damage-in-2018-is-astronomical-it-could-keep-climbing-15519504

[4]https://www.thestar.com/business/opinion/2019/05/21/canadas-rising-waters-a-coal-fired-climate-crisis-and-tim-hortons-us-flop.html

[5]“Climate impacts grow, and U.S. must act, says report”, Alejandra Borundra, National Geographic website, 23 November 2018. https://www.nationalgeographic.com/environment/2018/11/climate-change-US-report0/

[6]Davies, Stephen, “The Great Horse-Manure Crisis of 1894”, The Institute of Economic Affairs, September 2004.